- Phishing: A message, typically an email, asking for the victim's confidential information such as username, password, date of birth, etc. The data are then used to hack into accounts or carry out unauthorized banking transactions. The message will normally look like a legitimate request from a credible and trustworthy sender such as a bank. Rather than replying immediately, check the content of the email carefully. If you have any doubts, contact your bank.

- Pharming: A type of fraud similar to phishing. The difference is that with pharming, the legitimate website traffic is manipulated to redirect the users to fake websites, designed to look like legitimate websites. This can lead to malicious software being installed in the victim's computer, or to confidential information, such as passwords or banking data being stolen.

- Vishing: This is phone phishing. Fraudsters call and pretend they work in the call centre of a legitimate financial or commercial institution. The potential victim is warned that there has been an attempted fraud involving their credit card. With that excuse, the fraudsters try to trick the victim into giving out personal details.

- Smishing: This is phishing via SMS. A text asks the victim to call a phone number or to click on a link (typically to a cloned website that looks exactly like the financial institution's real website), often with the promise of a discount or promotional offer. As usual, the aim is to steal confidential information.

- 3DSecure: This is an anti-fraud protection system for credit cards. It guarantees additional protection for online purchases by pairing the payment card with a one-time authorization code - which changes for every purchase - that works on websites that belong to 3DS.

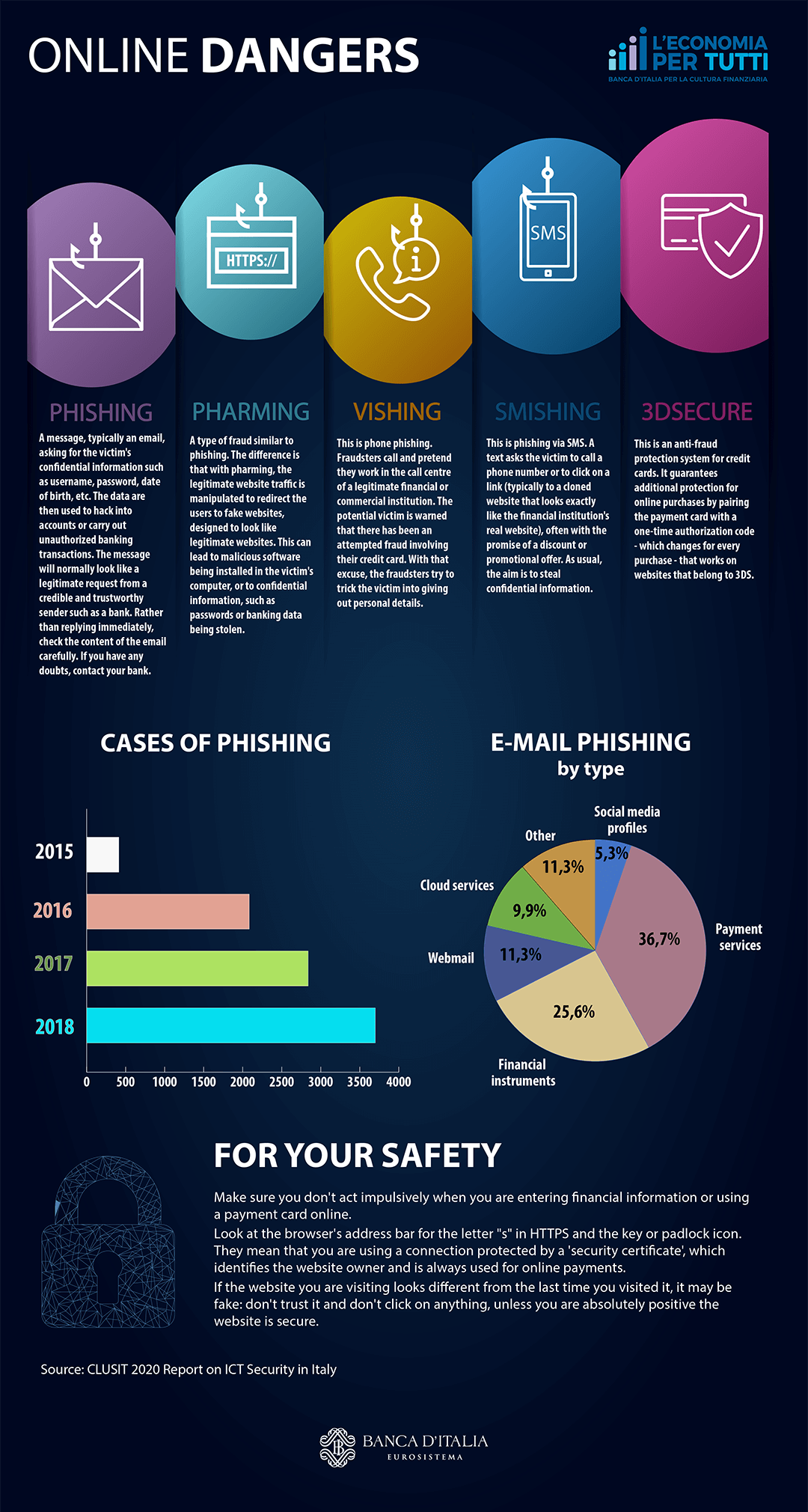

| Year | Cases of Phishing |

|---|

| 2015 |

412 |

| 2016 |

4083 |

| 2017 |

2838 |

| 2018 |

3699 |

| E-Mail phishing: | by tipe |

|---|

| Social media profiles |

5.3% |

| Payment services |

36.7% |

| Financial instruments |

25.6% |

| Webmail |

11.3% |

| Cloud services |

9.9% |

| Other |

11.3% |

For your safety

Make sure you don't act impulsively when you are entering financial information or using a payment card online.

Look at the browser's address bar for the letter "s" in HTTPS and the key or padlock icon. They mean that you are using a connection protected by a 'security certificate', which identifies the website owner and is always used for online payments.

If the website you are visiting looks different from the last time you visited it, it may be fake: don't trust it and don't click on anything, unless you are absolutely positive the website is secure.

Source

- CLUSIT 2020 Report on ICT Security in Italy