Sustainable Finance

Sustainable finance refers to the process of taking environmental, social and governance (ESG) considerations into account when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects. Sustainable finance, therefore, applies the concept of sustainable development to financial activities.

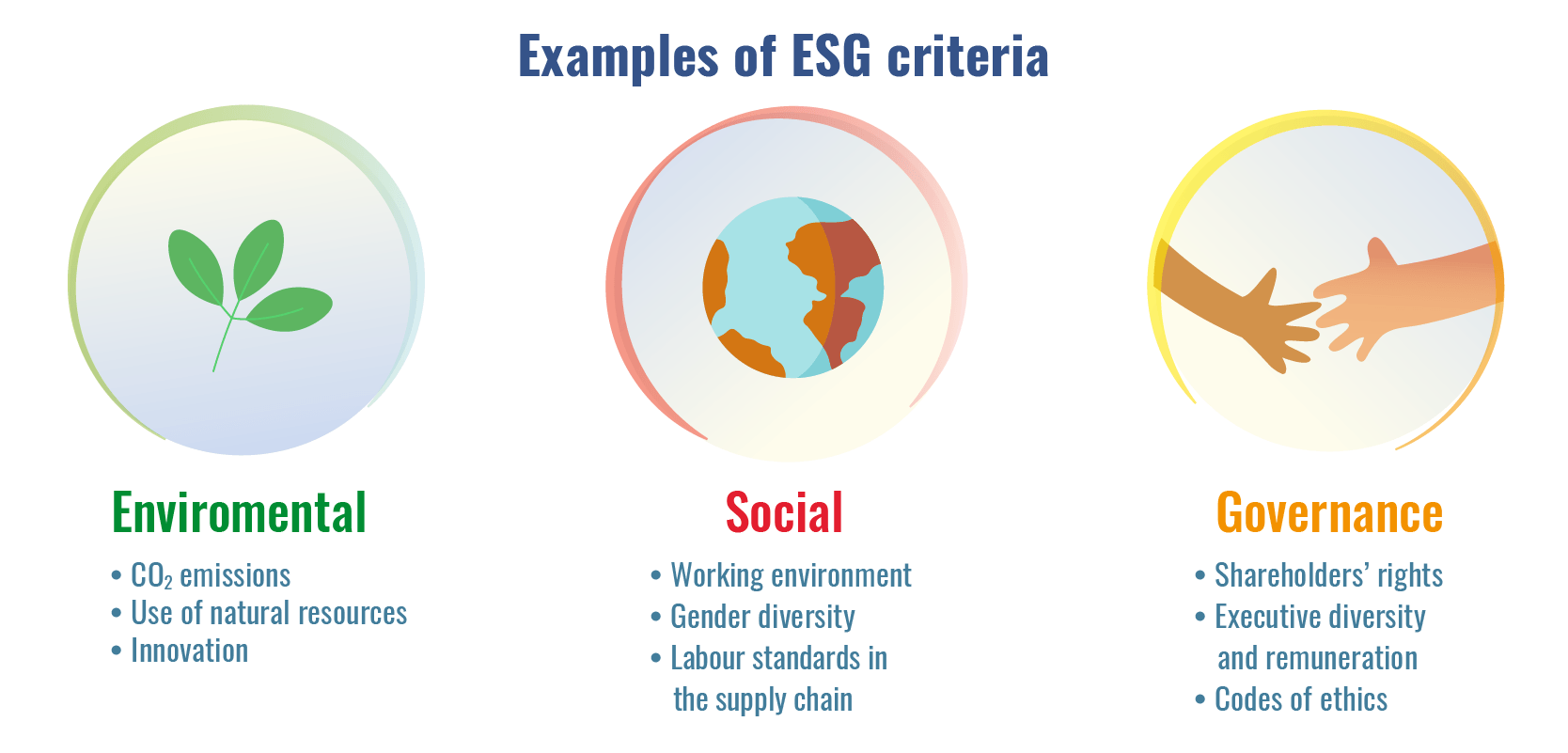

What exactly are these ESG considerations? Environmental considerations include climate change mitigation and adaptation, the transition toward a net-zero emissions economy (climate neutrality), as well as the environment more broadly, for instance the preservation of biodiversity, pollution prevention and the circular economy. Social considerations refer to issues of inequality, inclusiveness, labour relations, investment in human capital and communities, as well as human rights issues. Lastly, the governance of public and private institutions plays a fundamental role in ensuring the inclusion of social and environmental considerations in the decision-making process, for instance through policies for diversity in management structures, the presence of external advisors, and executive remuneration.

Taking ESG considerations into account means investing in businesses that carry out sustainable economic activities, consistent with the UN Global Compact's Ten Principles in the areas of human rights, labour, the environment and anti-corruption, as well as with the UN 2030 Agenda for Sustainable Development goals and with the Paris Agreement on climate change.

How finance can help create a more sustainable world

The financial sector transfers resources from savers (referred to as 'stakeholders with a surplus', such as households) to borrowers ('stakeholders with a deficit', typically, businesses and the public administration). In deciding how to invest their money, savers and the financial intermediaries who manage their savings (such as investment funds or pension funds) play an essential role in economic development. The various stakeholders that operate in financial markets can actively work toward directing financial flows towards investments with a positive impact for society in the medium and long term.

Therefore, savers can choose to invest in businesses that, in addition to a financial return, generate a positive social and/or environmental return, for example: in businesses' that use natural resources responsibly and are aware of their effects on the ecosystem; in businesses' that maintain adequate health and safety conditions, equity, inclusion and social justice in the workplace; and in businesses' that pay attention to ethical principles and the best corporate governance practices.

Alternatively, savers can choose not to invest in businesses that do not abide by international agreements on workers' rights, or that operate in sectors not compliant with international treaties, such as the one that bans the production of controversial weapons (biological and chemical weapons, anti-personnel mines).

When an investment can be considered to be sustainable

An investment is deemed sustainable on the basis of ESG scores, which rate the environmental, social and governance sustainability of issuers (firms, States, supranational organizations), stocks and bonds, and collective investment schemes (UCITs and ETFs).

ESG scores are attributed by specialized agencies, which analyse information published by the company (non-financial disclosure) or obtained through other sources (questionnaires, databases, news). Such information refers to the sustainability criteria that the company adopts in its management and investment projects. As well as ESG scores, which provide a combined assessment of a firm's sustainability, the agencies can provide data on single aspects (e.g. on carbon emissions, water consumption, etc.).

However, sustainability assessment standards are not balanced at an international level. Therefore, the criteria used in terms of the dataset and methodology in order to create ESG scores and rate an economic activity as sustainable need to be aligned within a consistent framework.

Nevertheless, ESG scores are widely used in finance in order to select financial instruments, build investment portfolios and create market indexes that are deemed sustainable or ESG-compliant

Possible strategies for sustainable investment

Responsible sustainable investments can combine several strategies, aimed either at specific climate objectives or at broader sustainability objectives (referring to social and governance issues). According to the categorization from the Eurosif and from the Principles for Sustainable Investment of the United Nations (UN PRI), the sustainable investment strategies are as follows:

- Negative/exclusionary screening: the exclusion from a portfolio of companies or sectors based on activities considered non investable on the basis of specific criteria referring to product categories (weapons, tobacco) or company practices (animal testing);

- Norm-based screening: screening of investments against minimum standards of business or issuer practice based on international norms such as those issued by the UN, ILO, OECD and other UN Specialized Agencies;

- ESG integration: the systematic and explicit inclusion by investment managers of environmental, social and governance factors into financial analysis: the integration process focuses on the potential impact of ESG factors on firms' returns and risks and this, in turn, influences their investment decisions;

- Best-in-class/ positive screening: investment in sectors, companies or projects selected for positive ESG performance relative to industry peers, and that achieve a rating above a defined threshold;

- Impact investing: Investing in companies, organizations and funds that aim to achieve positive, social and environmental impacts in addition to financial returns: these are usually very specific investments such as those in micro-finance or in social or green bonds;

- Sustainability themed/thematic investing: Investing in themes or assets specifically contributing to sustainable solutions - environmental and social - (e.g., renewable energy, energy efficiency, health);

- Corporate engagement & shareholder action: Employing shareholder power to influence corporate behaviour, including through direct corporate engagement and proxy voting that is guided by comprehensive ESG guidelines.

Climate change and the risks of the financial system

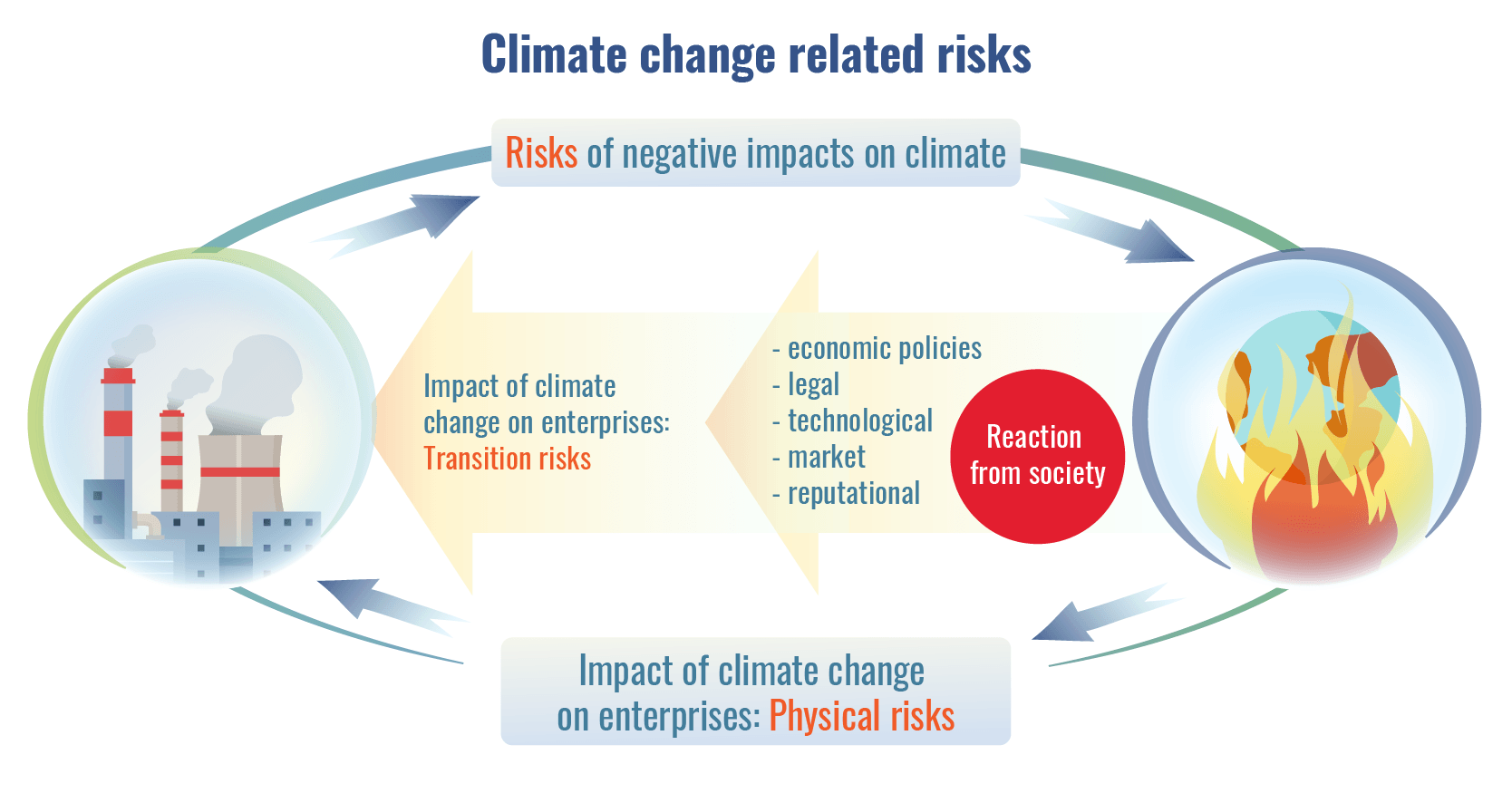

Climate change and the relevant mitigation policies expose enterprises and their financial assets to a series of risks, in the first place, to physical risks arising from natural catastrophes due to climate change. Extreme meteorological phenomena may be chronic, like progressively increasing temperatures and rainfall, or occasional, like flooding, hurricanes, heatwaves, etc. which cause serious damage to the territories concerned. Enterprises damaged by adverse weather events may undergo a potential depreciation of their bonds and shares entailing losses for financial intermediaries and investors.

In the second place, there are a transition risks due to the shift to new energy production and consumption systems in order to reduce greenhouse gas emissions. For example, the measures adopted by public authorities to ensure transition to a low CO2 emission economy require accurate planning otherwise they could penalize enterprises operating in the energy and automobile industries with potential repercussions on the credit institutions that finance them and, consequently, on investors.

These risks can increase the financial system's vulnerability. Therefore, it is necessary to monitor them according to the information provided by operators about their exposure to those risks.

The infographic 'Credit to firms exposed to climate risks' presents some estimates of the exposure of the Italian banking system to the credit risk associated with climate change.

Global agreements and the EU's commitment to fight climate change

Green finance plays a key role in fulfilling the international commitment to the cause of climate and environmentally sustainable development such as the Paris Agreement on climate change and the United Nations' Sustainable Development Goals for the 2030 Agenda. In particular, by signing the Paris agreement, the first legally binding universal treaty on climate change, the international community has made the commitment to reduce the concentration of greenhouse gas in the atmosphere by converting productive sectors to low-emission production models. The Agreement provides that worldwide greenhouse gas neutrality should be rapidly achieved to keep the increase in the global average temperature to well below 2℃ above pre-industrial levels and carry on the action to limit that increase to 1.5C°. The commitments made by the countries are discussed during the UN Climate Change Conferences of the Parties. The 26th Conference (COP26) took place in Glasgow in November 2021.

The European Commission presented the European Green Deal in 2019 as 'a new growth strategy that aims to transform the EU into a fair and prosperous society, with a modern, resource-efficient and competitive economy where there are no net emissions of greenhouse gases in 2050 and where economic growth is decoupled from resource use.' Europe's intention is to be the first continent to achieve climate neutrality through a defined series of intermediate milestones and instruments to reach them.

To achieve the goals set by the European Green Deal, the Sustainable Europe Investment Plan will mobilize €1 trillion in sustainable investments over the next decade.

The EU Commission action plan on financing sustainable growth, published in 2018, involved the private sector in financing the decarbonization of the European economy. The Plan outlines the strategy and the measures to implement a financial system capable of promoting economically, socially and environmentally sustainable development.

Green finance

Green finance is part of sustainable finance and concerns financial instruments facilitating environmentally sustainable development, energy transition and the fight against global warming. Investors and financial institutions can actually contribute to combating climate change by investing in enterprises and projects pursuing objectives related to energy transition and environmental protection.

Although green finance is greatly expanding, a harmonized regulatory framework and criteria to define what is green and what is not are not yet available. For this reason, the European Union and the competent financial regulatory authorities are developing rules on green finance. These will enable investors interested in green finance to avoid the greenwashing risk, that is, the unsubstantiated or false claims that the investments are green.