The social cost of payment instruments

Payment methods and the costs borne by society

We all know that there are many different payment methods available to us, and that it is important to choose and use them based on our actual needs, while also comparing their costs.

A recent study, The Social Cost of Payment Instruments in Italy, carried out by Banca d'Italia as part of the Italian Payments Committee (CPI), offers insights into a fast-evolving world that plays an important role in our daily lives.

When we use cash, it may seem that – beyond production costs – there are no further expenses involved, especially compared to the complex technologies behind alternative payment methods such as cards or credit transfers. Banks, merchants and businesses incur indeed, a variety of costs related to cash handling and storage, cash collection and transport, deposits and withdrawals, reconciliation and accounting.

There is a real 'backstage' to the payments ecosystem. All the actors involved – banks, merchants and companies – bear costs that vary depending on the type of payment method: from cash and cheques to credit transfers, payment cards and direct debits.

What do the data show?

The Italian Payments Committee regularly asks payment service providers and businesses to estimate the costs involved in offering and using different payment instruments. The most recent survey, based on 2022 data, involved a sample of over 900 banks and companies. The aim was to assess the social costs of the system - that is, the overall costs borne by society to carry out transactions.

The sum of the 'private' costs sustained by these participants (excluding costs incurred in relation to other banks, merchants or companies) is referred to as the social cost of payment instruments. This is a cost that households are not always directly aware of, but which they ultimately bear when carrying out banking transactions. Lower system-wide costs benefit everyone.

In 2022, the social cost in Italy was estimated at around €12 billion. A key point to note is that, as a share of GDP, this cost has declined compared with previous surveys carried out in 2009 and 2016.

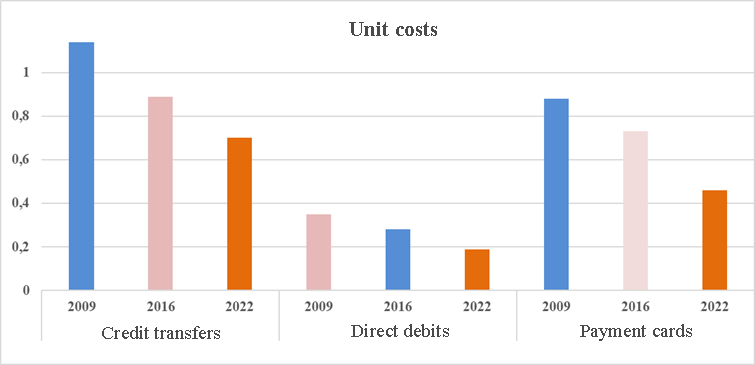

In general, the unit cost of most payment instruments has decreased over time – with the exception of cheques, which are used less and less frequently. A comparison across the three surveys shows that the unit cost of credit transfers, payment cards and direct debits has fallen, largely thanks to a rise in the number of transactions (see chart). For example, the number of card transactions more than doubled between 2016 and 2022.

System developments and consumer preferences

The Covid-19 pandemic accelerated an already ongoing shift towards digital payment tools. In 2021 alone, the number of transactions made using alternatives to cash rose by 24 per cent.

Italy has proven to be one of the most dynamic countries in terms of the sector's development:

- the use of payment cards grew at a faster pace than in the euro area as a whole;

- the same applies to instant credit transfers, which increased by 63.1 per cent in 2023 compared to the previous year.

Nonetheless, there remains a gap between Italy and other European countries. In 2023, the number of non-cash transactions per capita in Italy exceeded 223, compared with a European average of 400 transactions.

Youtube

Youtube

X - Banca d’Italia

X - Banca d’Italia

Linkedin

Linkedin

RSS

RSS