Instant credit transfers: benefits, risks and protections

An instant credit transfer is a payment service that allows money to be moved from one account to another with exceptional speed. The transaction is completed in a maximum time of 10 seconds and is available 24 hours a day, 7 days a week-unlike traditional credit transfers, which typically take one working day to be credited.

The benefits of speed

The ability to make real-time transfers offers clear advantages. For merchants and professionals, the advantage is receiving payments immediately. For consumers, an instant credit transfer is very convenient when funds need to be transferred at the same time as a purchase is made. This is often the case, for example, when buying a used car and payment is required at the moment of ownership transfer, or in shops when the amount exceeds card limits and the recipient needs the money to be instantly available in their account.

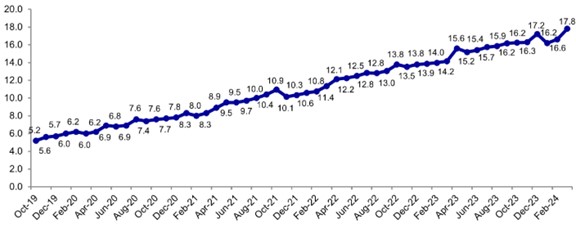

Unsurprisingly, the use of instant credit transfers is growing across the euro area.

Figure 1

Percentage of instant credit transfers out of total credit transfers in the euro area

(percentage values)

[The chart shows the percentage share of instant credit transfers out of the total number of credit transfers in the euro area from 2019 to 2024. The trend increased steadily from around 5% at the end of 2019 to nearly 18% by early 2024.]

Risks

Speed, however, is also the drawback of instant credit transfers. According to Banca d'Italia's latest Report on Fraudulent Payment Transactions in Italy - Second Half of 2024, the fraud rate for instant transfers is higher than for standard ones. Once initiated, instant transfers cannot be reversed, making them particularly attractive to fraudsters who want to receive stolen money as quickly as possible.

That said, the numbers remain relatively low: only 0.027% of instant transfers resulted in fraud (data from the second half of 2024).

Customer protection: how to prevent fraud

Instant credit transfers benefit from the same protections as standard transfers, including Strong Customer Authentication (SCA). This system ensures that it's really you who is making the payment by requiring at least two independent and strictly personal security factors-such as your account password and a code sent to your smartphone.

However, 67% of money lost to fraud (whether through instant or standard transfers) is due to payer manipulation. This technique bypasses SCA because we ourselves carry out the payment. Fraudsters use various tactics to persuade us to send money-often by pretending a relative is in trouble, for example.

Another 31% of fraud cases involve payments made directly by the fraudster, who may gain access to our online banking.

To make life harder for scammers, we can follow some simple but effective safety rules.

In cases of manipulation-based scams, it's important to be wary of anyone who creates a sense of urgency or fear-whether via message or phone call. If in doubt, always verify the identity of the person contacting you before making a transfer. Do this by calling them back using contact details from your own address book or by searching for them online, rather than using the ones provided in the message or call.

Once you're sure about the person or company you're sending money to, double-check that the IBAN and recipient name match. For example, if someone calls claiming to be from your electricity provider and you do have a bill to pay, make sure the IBAN belongs to your actual provider-not the fraudster.

On 9 October 2025, new rules will come into effect to help protect against fraud. Banks and postal services will be required to offer an automatic verification service that checks whether the recipient's name matches the IBAN. Before completing a transfer, your bank will alert you if the details don't match-helping you avoid scams where fraudsters trick you into entering their IBAN instead of the intended recipient's.

In cases where the fraudster initiates the payment, prevention is simpler. Just follow these key rules:

- Never share your codes or passwords-not even with your bank

- Never click on links received via email or SMS

Customer protection: how to request a refund

If we notice payments that we haven't authorised, we can always dispute them and request a refund from our financial provider. This is our legal right, as long as we have acted responsibly - for example, by not falling for the most basic and common scams.

Even in cases of fraud involving credit transfers, we don't always lose money. In fact, 29% of the amounts lost through fraudulent transfers - roughly one euro in every three (as of the second half of 2024) - are reimbursed by financial providers.

From 9 October onwards, if a provider fails to start a verification process to check that the beneficiary's name matches the IBAN, as required by law, they will be held responsible for executing a transfer to the wrong recipient and must immediately refund the account holder.

Customer protection: what to do if your provider acts improperly

Finally, if we believe that a financial provider has acted improperly or irregularly, we have the right to file a complaint directly with them. They must reply within 15 days. If the reply is unsatisfactory or not received within the legal timeframe, we can report the issue to Banca d'Italia and submit a claim to the Banking and Financial Ombudsman (ABF).

The claim process costs just €20, which is refunded if the outcome is in our favour, and there is no need for legal assistance.

Youtube

Youtube

X - Banca d’Italia

X - Banca d’Italia

Linkedin

Linkedin

RSS

RSS