IBAN

Making a credit transfer becomes a small exercise in patience when it comes to entering the IBAN, but there's a good reason why this code is so long. Let's see what this sequence of numbers and letters is, what it's for, and why you need to be very careful when entering it.

What is the IBAN code?

The IBAN code is a code that uniquely identifies each bank account through a series of numbers and letters, much like a vehicle registration plate. 'IBAN' is an acronym standing for International Bank Account Number. Knowing this code is essential for making credit transfers and for authorising direct debits to pay bills automatically.

The IBAN code is a code that uniquely identifies each bank account through a series of numbers and letters, much like a vehicle registration plate. 'IBAN' is an acronym standing for International Bank Account Number. Knowing this code is essential for making credit transfers and for authorising direct debits to pay bills automatically.

You can think of the IBAN code as the address of a bank account. To make a transfer, you need to enter the IBAN of the account to which you want to send money - along with the beneficiary's name, the reason for the payment (the payment reference), and the amount to be transferred.

Even a single wrong digit can send the money to the wrong recipient, much like entering the wrong house number when sending a parcel.

The IBAN system has been adopted by many countries, primarily those in the European Union. While widespread, it is not a universal system: some large countries, such as the United States, China, and Brazil, use different banking identification systems.

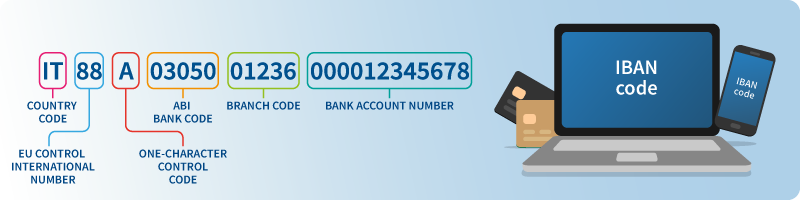

The IBAN length varies worldwide, from 15 characters in Norway to 31 in Malta. In Italy, it has 27 characters, divided as follows:

The structure of the IBAN code

The sequence indicates the country (the first two characters), the bank (with its five-digit ABI code), the bank branch or agency (with its five-digit CAB code), and the bank account number (twelve digits). Immediately after the country code - 'IT' in Italy - there are two numbers and a letter that form the CIN code, a check code automatically verified before every transaction.

Prepaid cards can also have an IBAN. These are called account cards or IBAN cards and offer some services typical of current accounts, such as credit transfers, automatic bill payments, and direct deposit of salary payments.

The risks

What happens if you enter the wrong IBAN? It depends. If the code does not exist, the money transfer will not go through and you will receive an error message, giving you the chance to correct it. However, if the IBAN exists, the money will be sent to the corresponding account, which will be different from the intended recipient's.

In the case of a transfer to the wrong account, the bank is obliged to do its best to recover the funds but is not held responsible for the mistake: the responsibility lies with the person who entered the incorrect IBAN. Moreover, if the unintended recipient refuses to return the money, there is little you can do to recover it except pursuing legal action.

From October 2025, banks and the Italian postal service are required to offer customers the possibility to verify the correspondence between the beneficiary's name and the IBAN. From 2027, this obligation will extend to other payment service providers, such as Payment Institutions (IP) and Electronic Money Institutions (IMEL). This measure will help prevent errors but will not always protect against fraud, which requires us to remain vigilant at all times.

Youtube

Youtube

X - Banca d’Italia

X - Banca d’Italia

Linkedin

Linkedin

RSS

RSS