Investment funds

Did you know that when you invest, it's important to diversify - by buying bonds issued by various public and private entities, stocks from different companies and countries, and so on? But how can you navigate through thousands of different instruments, especially if you only have a small amount to invest? The solution is to invest by subscribing to an investment fund or buying an ETF (Exchange Traded Fund). These are both containers that hold dozens, hundreds, or even thousands of different instruments. With an ETF or an investment fund, you can easily diversify your investments.

Here, we focus in particular on investment funds - the advantages they can offer you, the risks to be aware of, and the costs you need to consider.

What is an investment fund?

You can think of an investment fund as a container - a portfolio - that includes many financial instruments, such as shares and bonds issued by different companies and governments. Leaving aside the effects of costs and taxes, the return on your fund investment will be similar to what you would earn by directly investing in each of the instruments held by the fund.

These funds are therefore investment tools. By joining a fund, you entrust your savings to a professional who manages them – along with other investors' savings - based on their expertise and experience (this is called 'asset management'). To participate, you subscribe to fund units that represent shares in the fund's total assets.

The value of each unit changes over time based on the performance of the fund's investments and is calculated according to the Net Asset Value (NAV) on a specific reference date. A fund's rules ensure fairness and transparency for all investors.

The collective management of investment funds is carried out by asset management companies (AMCs, in Italian SGRs). Similar activities may also be carried out by open-end investment companies (in Italian SICAVs) or closed-end investment companies (in Italian SICAFs).

To learn more about a fund's features, you can consult its KID (Key Information Document).

Types of funds

There are two main types of investment funds based on management style:

- passively managed funds. Here, the manager aims to achieve returns in line with a benchmark index, such as Italy's FTSE MIB stock index. The fund's portfolio is structured to reflect the composition of that index. The management is considered passive because the manager simply "copies" the index rather than selecting individual securities;

- actively managed funds. In this case, the manager is not trying to replicate an index but has more freedom to choose investments. These funds often aim to outperform a reference index (benchmark) and rely on the manager's skill to do so.

What is a stock index?

It's a measure of the performance of a group of stocks, moving up or down based on their average prices. The FTSE MIB (Financial Times Stock Exchange Milano Indice di Borsa) is Italy's most well-known stock index and includes around 40 major Italian companies listed on the stock exchange.

Another useful classification is based on income treatment:

- distribution fund (DIST): the fund distributes income (such as coupons and dividends) periodically to investors. This means you typically receive money annually into your linked account as part of the fund's overall return.

- accumulation fund (ACC): the fund reinvests all income back into the fund instead of distributing it. If returns are positive, your investment may grow faster over time through the effect of compound interest. To withdraw money, you need to redeem some of your fund units.

The advantages of investing in a fund

Investing in a fund offers several advantages:

- professional management of your money;

- easy diversification of your investment, even with small amounts, because each fund unit includes a wide range of stocks or bonds;

- potentially lower fees, especially for trading individual securities, since professional managers can negotiate better terms and spread fixed costs across large amounts of capital;

- if the fund is accumulation-based and delivers positive returns, taxation is deferred until you redeem your units, which allows your investment to grow more effectively.

The risks

No matter how skilled the fund manager is, the value of the securities held in the fund—and therefore your fund units - can always go down.

To assess the risk level of a specific fund, check its KID.

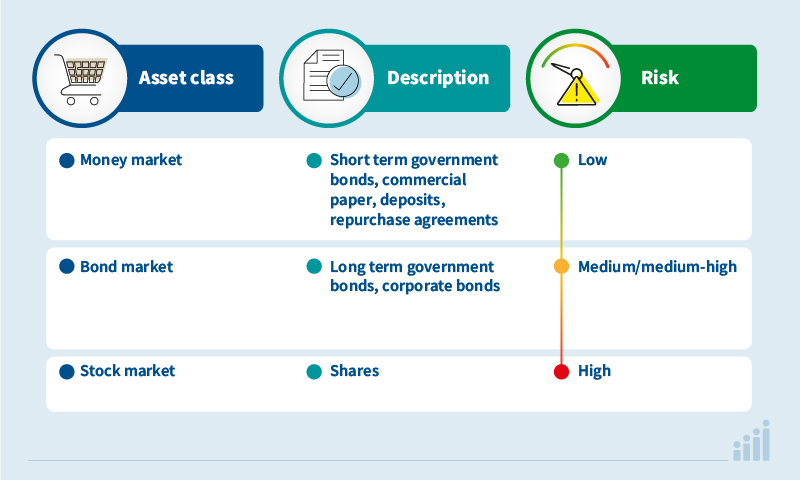

In general, risk levels can be grouped into three main categories based on the type of assets held.

Remember that, even in the case of low risk, there is no guarantee regarding the performance or the full repayment of the invested capital; everything depends on the performance of the financial markets and the results of the fund. Additionally, costs can significantly impact the net return of the fund.

However, you are protected from the risks of a potential bankruptcy of the manager. The fund's assets are, in fact, legally separate from those of the manager. The manager's creditors cannot, therefore, claim the fund's assets. Moreover, the custodian bank, which is separate from the manager, holds the fund's money and financial instruments and performs some checks, including calculating the share value.

Costs

How much does it cost to invest in a mutual fund? On average, Italian mutual funds are more expensive than those in other European countries, especially compared to ETFs.

In the specific fund's KID (Key Information Document), you will find information on costs, including an indication of how they reduce the value of your investment over time.

There are different types of fund costs. Therefore, in the KID, you will find:

- one-time fees: the maximum amount of commissions you may pay when subscribing to the fund's shares and when redeeming them;

- ongoing charges: the main periodic fees, including management fees, which are the compensation for the fund manager;

- transaction costs: these include brokerage fees (or intermediation), which are the costs incurred by the fund when buying or selling financial instruments;

- additional costs: for actively managed funds, these are the fees to be paid to the manager when the fund's performance exceeds that of the benchmark index. For Italian law funds, these fees are calculated based on instructions from Banca d'Italia.

Also, remember that the returns on your investment are taxed.

The payment of ongoing charges, transaction costs, and additional costs is done through periodic deductions from the fund's assets. These costs can therefore have a significant impact on the final result of your investment, especially as time passes. The additional cost of actively managed funds should be justified by the manager's ability to generate high absolute returns with a low level of risk, or returns higher than the benchmark indexes.

Youtube

Youtube

X - Banca d’Italia

X - Banca d’Italia

Linkedin

Linkedin

RSS

RSS