Fondi comuni di investimento

Sai che quando investi è importante diversificare, cioè comprare obbligazioni emesse da più soggetti, pubblici e privati, azioni di diverse società e paesi, ecc. Ma come districarsi tra migliaia di strumenti diversi, casomai avendo a disposizione solo una piccola somma? La soluzione è investire sottoscrivendo un fondo comune di investimento o comprando un ETF (Exchange Traded Fund, in italiano "fondo scambiato sul mercato"). Sono entrambi contenitori di decine o centinaia di strumenti diversi, talvolta anche migliaia. Con un ETF o un fondo comune puoi, quindi, diversificare i tuoi investimenti molto facilmente.

Parliamo qui in particolare dei fondi comuni, dei vantaggi che possono offrirti, dei rischi a cui devi badare e dei costi che devi mettere in conto.

Cos'è un fondo comune di investimento

Puoi pensare al fondo comune come a un contenitore, un portafoglio, che ha al suo interno tanti strumenti finanziari, ad esempio azioni e obbligazioni di diverse società e governi. Trascurando l'effetto dei costi e delle tasse, il guadagno che otterrai, cioè il rendimento del tuo investimento nel fondo, sarà simile a quello che otterresti investendo in tutti i singoli strumenti in cui investe il fondo.

I fondi comuni sono, quindi, strumenti di investimento. Aderendo a un fondo affidi i tuoi risparmi a un esperto che li amministra, insieme ai risparmi di altri soggetti, sulla base delle sue competenze e della sua esperienza (risparmio gestito). Per aderire, sottoscrivi delle quote che rappresentano parte del patrimonio complessivo del fondo.

Il valore della quota varia nel tempo in base ai risultati ottenuti dagli investimenti del fondo ed è calcolato sulla base del "valore netto" (NAV, cioè Net Asset Value) degli attivi in gestione alla data di riferimento. Un regolamento del fondo assicura correttezza e trasparenza sul suo funzionamento ai partecipanti.

La gestione collettiva tramite fondi comuni di investimento è affidata alle società di gestione del risparmio (SGR). La stessa attività di investimento può essere svolta dalle società di investimento a capitale variabile (SICAV) o a capitale fisso (SICAF).

Per conoscere le caratteristiche principali di un fondo puoi consultare il relativo KID (Key Information Document), il "Documento delle informazioni chiave".

I tipi di fondo

Esistono due tipi principali di fondo in base allo stile di gestione:

- fondi a gestione passiva. In quanto caso il gestore ha come obiettivo quello di ottenere un rendimento in linea con un indice di riferimento o benchmark, ad esempio uno degli indici del mercato azionario italiano, l'FTSE MIB. Per far ciò, investe in modo che il portafoglio del fondo rispecchi la composizione dell'indice. Lo stile di gestione è passivo proprio perché il gestore si limita a "copiare" l'indice, anziché scegliere in autonomia gli strumenti finanziari da comprare;

- fondi a gestione attiva. In questo caso il gestore non mira, almeno formalmente, a replicare fedelmente l'andamento di un indice e ha una libertà di scelta più o meno ampia sulla composizione degli investimenti del fondo. Spesso, i fondi a gestione attiva hanno come obiettivo quello di ottenere un rendimento più elevato rispetto a un indice di riferimento (benchmark).

Cos'è un indice azionario?

È un indicatore dell'andamento di un gruppo di azioni; si muove al rialzo o al ribasso riflettendo l'andamento del prezzo delle azioni che lo compongono.

Il FTSE MIB, Financial Times Stock Exchange Milano Indice di Borsa, è l'indice più conosciuto del mercato azionario italiano; è composto da circa 40 azioni delle principali società italiane quotate in borsa.

C'è anche un'altra classificazione dei fondi a cui ti consigliamo di fare attenzione, quella tra fondo a distribuzione e fondo ad accumulazione:

- fondo a distribuzione (DIST). Il gestore distribuisce periodicamente ai partecipanti i proventi, come le cedole e i dividendi, derivanti dagli strumenti finanziari che costituiscono il patrimonio del fondo. In altre parole, aderendo a questo tipo di fondo riceverai, tipicamente ogni anno, del denaro sul conto a cui il fondo è collegato come parte del rendimento complessivo del fondo;

- fondo ad accumulazione (ACC). Il gestore reinveste direttamente nel fondo tutti i proventi, anziché distribuirli periodicamente ai partecipanti. Se i rendimenti del fondo sono positivi, la somma che hai investito può aumentare così più velocemente nel corso del tempo, grazie alla "magia dell'interesse composto". Nel caso dei fondi ad accumulazione, per ottenere del denaro dal tuo investimento dovrai "vendere" o meglio riscattare parte delle quote del fondo che possiedi.

I vantaggi di investire in un fondo

Investire in un fondo comune ti offre diversi vantaggi:

- affidi la gestione del denaro a professionisti;

- diversifichi facilmente i tuoi investimenti, anche se hai a disposizione solo una piccola somma, perché comprando una quota del fondo investi di fatto in centinaia di azioni o obbligazioni di diversi emittenti;

- contieni potenzialmente oneri e costi, tra cui quelli per l'acquisto e la vendita dei singoli strumenti finanziari. I gestori professionali sostengono costi minori e riescono a ripartire i costi fissi su importi gestiti elevati;

- se il fondo è ad accumulazione e i rendimenti sono positivi, rimandi parte della tassazione al momento del disinvestimento dal fondo e il tuo investimento cresce in misura maggiore.

I rischi a cui fare attenzione

Per quanto abile sia il gestore del fondo, il valore degli strumenti finanziari in cui investe e, quindi, il valore delle quote che tu hai sottoscritto può sempre diminuire.

Per conoscere il livello di rischiosità di un fondo specifico, consulta il relativo KID.

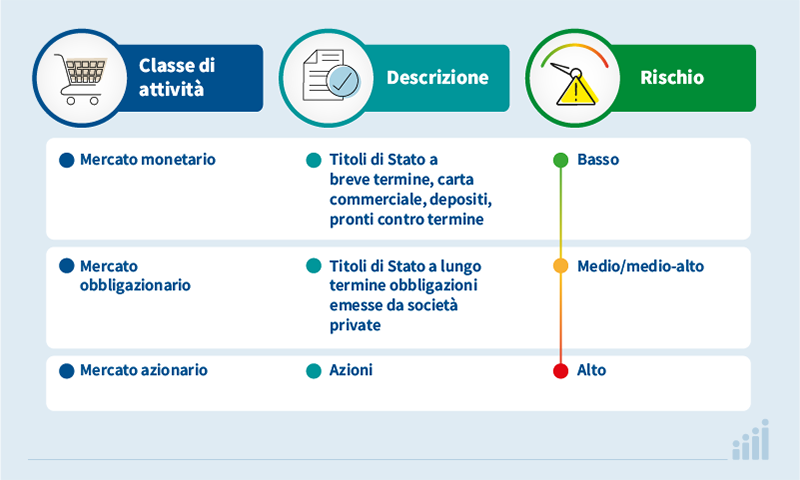

In generale, possiamo riassumere i differenti livelli di rischiosità di un investimento in tre categorie principali che corrispondono ad altrettanti tipi di strumenti in cui i fondi possono investire.

Ricorda che, anche in caso di rischio basso, non esiste alcuna garanzia sul rendimento o sulla restituzione integrale del capitale investito; tutto dipende dall'andamento dei mercati finanziari e dai risultati del fondo. Inoltre, i costi possono incidere in maniera significativa sul rendimento netto del fondo.

Sei invece tutelato dai rischi di un eventuale fallimento del gestore. Il patrimonio del fondo è, infatti, giuridicamente separato da quello del gestore. I creditori del gestore non possono, quindi, rivalersi sul patrimonio del fondo. Inoltre, la banca depositaria, diversa dal gestore, custodisce il denaro e gli strumenti finanziari del fondo ed effettua alcuni controlli, tra cui i calcoli del valore della quota.

I costi

Quanto costa investire in un fondo comune? In media, i fondi comuni italiani sono più costosi di quelli degli altri paesi europei e, soprattutto, degli ETF.

Nel KID dello specifico fondo troverai le informazioni sui costi, compresa l'indicazione di come riducono il valore del tuo investimento nel tempo.

I costi dei fondi sono di più tipi. Per questo, nel KID troverai:

- le spese una tantum, l'importo massimo delle commissioni che puoi pagare quando sottoscrivi le quote del fondo e quando le riscatti;

- le spese correnti, le spese periodiche principali, tra cui spiccano le commissioni di gestione, cioè il compenso per il gestore del fondo;

- i costi per le operazioni, includono le commissioni di negoziazione (o intermediazione), cioè i costi sostenuti dal fondo per comprare o vendere gli strumenti finanziari;

- i costi accessori, per i fondi a gestione attiva sono le commissioni da pagare al gestore quando i rendimenti del fondo sono superiori a quelli dell'indice di riferimento (benchmark). Per i fondi di diritto italiano, queste commissioni sono calcolate in base a indicazioni della Banca d'Italia.

Ricorda, poi, che i guadagni del tuo investimento sono tassati.

Il pagamento delle spese correnti, dei costi per le operazioni e dei costi accessori avviene con prelievo periodico dal patrimonio del fondo. Questi costi possono quindi avere un impatto molto elevato sul risultato finale del tuo investimento, soprattutto col trascorrere del tempo. Il costo aggiuntivo dei fondi a gestione attiva dovrebbe essere giustificato dalla capacità del gestore di ottenere rendimenti assoluti elevati con un livello di rischio contenuto o rendimenti più alti di quelli degli indici di riferimento (benchmark).

Youtube

Youtube

X - Banca d’Italia

X - Banca d’Italia

Linkedin

Linkedin

RSS

RSS