The Banking and Financial Ombudsman (ABF)

If you need to resolve a dispute with your bank or another intermediary relating to banking and financial services — such as a current account or card payments — you can file a complaint with the Banking and Financial Ombudsman (ABF).

What is the ABF?

The Banking and Financial Ombudsman (ABF) is an independent and impartial body for the out-of-court resolution of disputes that may arise between customers and banks or other intermediaries in connection with banking and financial operations and services. It provides a simpler, faster and more affordable alternative to civil court proceedings. The ABF is supported in its operation by Banca d'Italia.

The ABF is part of the ADR (Alternative Dispute Resolution) network — mechanisms used to resolve legal disputes without going through civil court proceedings.

LThe ABF is structured into seven Panels (Collegi) located in Bari, Bologna, Milan, Naples, Palermo, Rome, and Turin.

Each Panel is supported by a technical secretariat composed of Bank of Italy staff. Decisions are made by five members of the Panel selected on the basis of professional experience, integrity, and independence. Two members and the Chair are appointed by Banca d'Italia, one by intermediaries' associations, and one by consumer or business associations.

Filing a complaint with the ABF is:

- simple - you do not need a lawyer or professional assistance to complete the application. However, you may appoint someone to represent you by submitting a written authorisation, available on the ABF website;

- fast - the average time to receive a decision is four months;

- affordable - the procedure costs only €20. If your complaint is upheld, even partially, the intermediary must reimburse this fee.

You can appeal to the ABF if:

- the dispute concerns banking or financial services, including payment services (e.g. delayed transfer of payment services when switching accounts, a negative report to the interbank alert system without prior notice, or fraud involving credit cards or other payment instruments);

- the issue arose within the past six years;

- the amount in dispute does not exceed €200,000.

Individuals and businesses may submit complaints, but the €200,000 limit makes the ABF particularly well-suited to individual consumers.

Disputes

You can turn to the ABF for disputes concerning, for example, current accounts, loans, credit cards, and postal savings bonds. You can ask for the recognition of rights and obligations — e.g. failure to provide transparency documents or to cancel a mortgage after it's been paid off. You can also turn to the ABF in case of fraud, where the intermediary refuses to compensate you even though you acted responsibly (e.g. securely storing your credentials, yet your account was accessed by a fraudster).

How to submit a complaint to the ABF

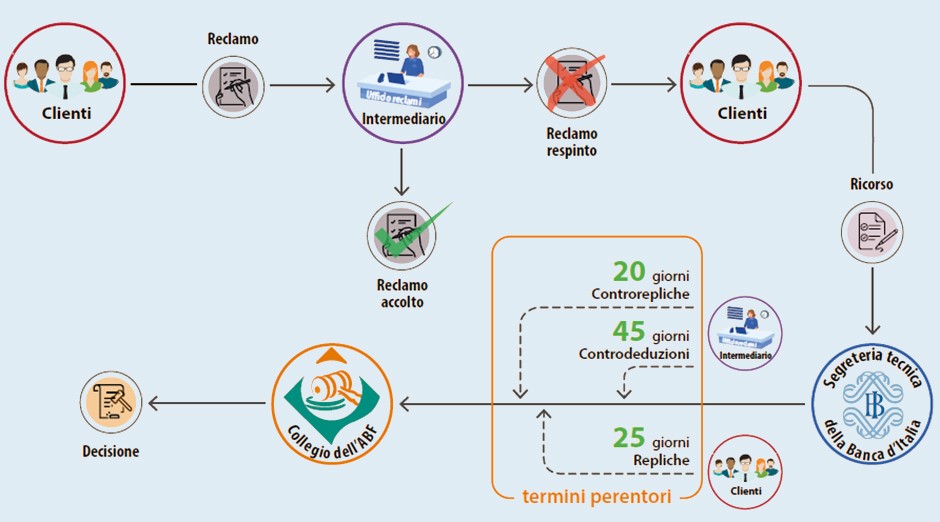

Before submitting a complaint to the Banking and financial Ombudsman (ABF), you must send a written complaint to the financial intermediary involved in the dispute. The intermediary has 60 days to accept or reject your request (this period is reduced to 15 days if the dispute concerns payment services, such as bank transfers or credit cards). If the intermediary upholds your complaint, they will take the necessary corrective actions. If your request is rejected, you receive no reply, or you are not satisfied with the response, you may proceed to submit a complaint online through the ABF portal.

You can submit a complaint to the ABF no later than 12 months after filing the initial complaint with the intermediary. If more than 12 months have passed, you must submit a new complaint to the intermediary before referring the matter to the ABF.

Only in specific cases, you may submit a complaint to the ABF in paper form — for example, if the dispute involves two or more intermediaries simultaneously, or if the intermediary operates abroad but provides services in Italy.

In these instances, you may send all documents by post or certified email (PEC) to the relevant ABF panel for your area or to any Branch of Banca d'Italia. Alternatively, you may deliver the documents in person at a Bank of Italy branch open to the public.

Your complaint will be handled by the technical secretariat of the ABF panel competent for your area of residence. The secretariat will verify the completeness, regularity, and timeliness of your documentation. After an initial review of the facts, the secretariat will forward the complaint to the intermediary, who will have 45 days to respond with their counterarguments. You will then have 25 days to reply, and the intermediary may submit a final response within another 20 days. Once this exchange is complete, the case file will be sent to the ABF panel, which will communicate its decision within 90 days.

You can always interact with the ABF through the online portal — not only to check the status of your complaint but also to amend it to ensure it meets all the required criteria or to add further information. However, it is not possible to appear 'in person' or participate in hearings.

The decision

Is the Ombudsman's decision binding for you or the intermediary? No, the Ombudsman's decision is not legally binding. If either you or your bank are dissatisfied with the outcome, you may still bring the matter before the civil courts. However, intermediaries generally recognise the authority of the ABF, with an adherence rate to its decisions exceeding 70per cent.

Youtube

Youtube

X - Banca d’Italia

X - Banca d’Italia

Linkedin

Linkedin

RSS

RSS