Cheque

Although they are now used less frequently, cheques remain one of the tools available for making and receiving payments - particularly for larger expenses, such as buying a car. You may come across two types: the bank (or postal) cheque and the banker's draft (known in Italy as an 'assegno circolare'). Here, we'll look at what they have in common, how they differ, what they cost, and what risks are involved.

What is a cheque?

A cheque is a payment instrument linked to a bank or postal current account. It allows the issuer (the 'drawer') to instruct the bank (or the Post Office, in the case of a postal cheque) to pay a specified amount to another person, known as the payee. A banker's draft, on the other hand, does not have to be linked to a current account.

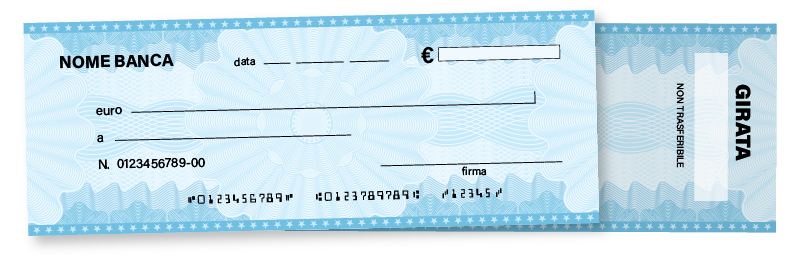

Cheques come in a standard printed format. To use one, you fill in the date and place of issue, the amount (in words and figures), the name of the payee, and your signature. The person signing the cheque is called the drawer.

A cheque is a credit instrument, which means it gives the payee the right to receive the specified amount from the issuer. Cheques are payable on demand, meaning they can be cashed as soon as they are presented to a bank or post office - provided there are sufficient funds in the drawer's account.

Payment can be made in cash (subject to legal limits) or directly into your current account. If the cheque does not carry the 'non-transferable' clause, it may also be used as a means of payment to someone else ('negotiation'). In order to do this, you need to sign the back of the cheque (a process called an 'endorsement'), thereby transferring the right to cash the cheque to another person.

Important!

If you endorse a cheque and the next holder fails to meet their obligations, you may be held liable. This is known as a 'right of recourse'.

How do you obtain cheques to use for your payments? If you hold a bank or postal current account, you can request a cheque book. These usually contain bank or postal cheques, not banker's drafts. To obtain a banker's draft, you must request one from a bank authorised by Banca d'Italia.

Most cheques today include the non-transferable clause by default. If you need bank or postal cheques without this clause (also known as 'open' cheques), you'll need to request them specifically and pay €1.50 in stamp duty per cheque, along with any issuance fees charged by your provider. Banker's drafts, by law, are always non-transferable.

The non-transferable clause means that only the person named as payee can cash the cheque. This is a safeguard against the use of cheques in money laundering, i.e. making illegal funds appear legitimate.

Types of cheque

A banker's draft is always backed by funds. To obtain one, you must either have the money in your account or pay it in at the time of request. As such, it is a secure and guaranteed instrument, issued by the bank itself.

A bank or postal cheque, by contrast, may be issued even if there are insufficient funds in the drawer's account. Such cheques are not always accepted as payment, due to the risk of a 'bounced cheque'.

If you issue a cheque without adequate funds (a 'bounced cheque'), you may face penalties and be recorded in the Interbank Register of Bad Cheques and Payment Cards (CAI), unless you make payment within 60 days of the deadline for presenting the cheque. Those listed in the CAI cannot issue cheques or open new cheque agreements for six months. Issuing a cheque without authorisation also results in automatic CAI registration by the bank within 20 days of the cheque being presented.

For more details about cheque regulations, protest procedures, and the CAI, consult the FAQs on Banca d'Italia's website.

How to cash a cheque

If you receive a cheque as payment, you must cash it within a specific time limit from the date of issue:

- 8 days if the cheque is payable in the same yown where it was issued (town cheques);

- 15 days if the cheque is payable in a different municipality (out-of-town cheques).

After these deadlines, the drawer can ask the bank not to honour the payment, and you may lose your legal protections – most importantly, the right to initiate a protest.

For banker's drafts, the time limit is 30 days from the date of issue. You must present them to the issuing bank. You can still present them after the deadline, but with fewer legal protections.

Once a cheque is paid in, the funds will typically be made available on your account within four working days, depending on your bank's conditions. This means the money may not be immediately accessible.

How to endorse a cheque over to someone else

If you're the payee and wish to endorse the cheque over to another person, first check whether your name is printed on it:

-

if your name is on the cheque as the payee, you can only transfer it if it does not carry the non-transferable clause, and the amount is under €1,000. To transfer it, sign the back – this is known as an endorsement;

-

if there is no named payee, the cheque can be passed on simply by handing it over. However, if you're not using a bank or authorised financial intermediary to do this, the amount must be under €5,000, as part of anti-money laundering regulations.

The costs of cheques

A cheque book (containing up to 20 bank or postal cheques) typically costs between €0 and €10, depending on your provider.

As mentioned earlier, if you request open cheques (without the non-transferable clause), you must pay stamp duty of €1.50 per cheque. When requesting a banker's draft, you'll usually be charged an issuance fee plus the €1.50 stamp duty.

Risks

Like cash, cheques are printed on special paper and include security features to prevent forgery. But there are still risks:

-

the cheque may be bounced - meaning there are insufficient funds in the drawer's account;

-

the cheque may be incomplete or altered, raising doubts about its authenticity, in which case the bank may refuse to accept it.

Filling in the cheque correctly protects you: it makes tampering more difficult and ensures validity.

As a precaution, even where not legally required (e.g. for bank or postal cheques under €1,000), it's advisable to name the payee and include the non-transferable clause. This reduces your liability if the cheque is passed on and the next holder fails to meet their obligations.

Tips for filling in a cheque:

- amount: write it both in figures and words. If the two differ, the amount in words prevails. Always include cents and place a # symbol before and after the figure to prevent fraud. For example, if the amount is €500, write down: #500,00#;

- date: it must match the day of signature and must include day, month, and year. This determines the time window for cashing the cheque and is used by the bank to record the transaction.

Important!

Post-dating a cheque - adding a future date in the hope of covering the funds later - is an administrative offence and is liable to pecuniary and prohibitive sanctions.

Youtube

Youtube

X - Banca d’Italia

X - Banca d’Italia

Linkedin

Linkedin

RSS

RSS