Microcredito

Il microcredito è uno strumento finanziario che ha l'obiettivo di sostenere la microimprenditorialità e favorire l'inclusione finanziaria di persone in difficoltà economica. Permette di ottenere prestiti di piccolo importo a persone e microimprese che non riescono a finanziarsi attraverso i canali di credito tradizionali - banche e altri intermediari finanziari - ad esempio perché non dispongono di garanzie (sono definiti, in gergo, "non bancabili").

Il concetto di microcredito non si esaurisce nella sola concessione del prestito: la normativa prevede che per tutta la durata del finanziamento ti siano obbligatoriamente forniti anche servizi di assistenza e monitoraggio, dalla fase che precede l'erogazione del prestito a quella successiva, per accompagnarti nella gestione finanziaria e nella tua attività imprenditoriale. Si tratta di un'offerta integrata di servizi finanziari e non finanziari. La differenza con il credito ordinario sta nella maggiore attenzione alla persona e alla validità e sostenibilità del progetto imprenditoriale che ti vede coinvolto.

Tipologie di microcredito

A seconda delle attività finanziate e dei soggetti che intende raggiungere, il microcredito può essere suddiviso in due grandi categorie: il microcredito imprenditoriale e il microcredito sociale.

Il microcredito imprenditoriale si rivolge a chi intende avviare o potenziare un'attività di microimpresa o di lavoro autonomo o ha difficoltà di accesso al credito bancario.

Trovi tutti i dettagli in merito ai soggetti beneficiari e alle caratteristiche del finanziamento che puoi ottenere - ad esempio la durata e l'importo massimo che ti può essere concesso - sul sito dell'Ente Nazionale per il Microcredito, nella sezione Finanziamenti.

Una caratteristica fondamentale di questo finanziamento è la garanzia pubblica del Fondo di garanzia per le Piccole e medie imprese, in genere pari all'80 per cento dell'importo finanziato.

Attenzione!

La Banca potrà richiederti ulteriori garanzie personali (non reali) solo per la parte non coperta dalla garanzia pubblica.

Questo vuol dire che se ricevi il finanziamento e non sarai in grado di rimborsarlo, lo farà lo Stato al tuo posto, fino all'80 per cento. Quando la garanzia viene concessa, gli intermediari finanziari sono assicurati che il prestito sarà restituito per la maggior parte, in ogni caso: saranno quindi disposti a finanziare un numero maggiore di interessati e possibilmente a condizioni migliori (ad esempio, potrebbero proporti tassi di interesse più convenienti rispetto a quelli di mercato).

Puoi utilizzare la somma ricevuta per acquistare beni e servizi da destinare all'attività d'impresa, come attrezzature, corsi di formazione o anche per pagare il personale dipendente. I servizi aggiuntivi forniti dal finanziatore o da altri soggetti possono riguardare consulenze ma anche supporto legale, fiscale e amministrativo-contabile.

Accedendo al microcredito imprenditoriale hai, infatti, la possibilità di ricevere l'assistenza di un tutor di Microcredito che ti aiuterà nella definizione e valutazione di sostenibilità della tua idea imprenditoriale e, dopo aver ottenuto il finanziamento, nella corretta conduzione della tua attività.

Se sei interessato al finanziamento, il primo step è quello di recarti in una delle banche convenzionate con l'Ente Nazionale per il Microcredito e presentare la tua richiesta. Da questo momento, un tutor ti assisterà, aiutandoti a capire se la tua idea è realizzabile.

Il microcredito sociale è rivolto a persone in situazioni di difficoltà economica e spesso si basa sull'iniziativa di enti pubblici (come Comuni e Regioni); alcuni intermediari finanziari sono impegnati stabilmente nel microcredito sociale, anche al di fuori di queste istituzioni. Il prestito erogato generalmente a tasso agevolato può aiutare a coprire spese per l'acquisto di beni o servizi primari come canoni di locazione, la riattivazione delle utenze domestiche o le spese sanitarie.

In aggiunta al finanziamento, anche in questo caso, il beneficiario è assistito da tutor (o associazioni di servizi) che aiutano, ad esempio, nella gestione delle spese, delle entrate e delle uscite. I destinatari del microcredito sociale non possono essere coperti dal Fondo di garanzia statale, ma può accadere che gli stessi enti pubblici promotori offrano garanzie sulla restituzione del prestito, con fondi dedicati.

Un'importante misura di inclusione promossa dal 2022 è il microcredito di libertà, destinato alle donne vittime di violenze o sfruttamento e assistite dai Centri Anti Violenza (CAV) o ospiti nelle Case Rifugio. Lo scopo è di favorirne l'autonomia economica e la reintegrazione sociale. Consiste nell'offerta di finanziamenti a tasso zero fino a 10.000 euro per superare una momentanea difficoltà finanziaria (microcredito sociale) o fino a 50.000 euro per iniziative imprenditoriali (microcredito imprenditoriale). Sono previsti anche qui l'assistenza di un tutor per l'aiuto nella gestione della pratica di finanziamento e corsi gratuiti di educazione finanziaria e all'autoimprenditorialità.

Le donne contano

Numerosi lavori di ricerca nazionali e internazionali mostrano che l'Italia ha un forte bisogno di alfabetizzazione finanziaria. Le donne ne sanno meno degli uomini, soprattutto quelle che hanno un livello di istruzione basso. A livello territoriale, il divario tra donne e uomini è maggiore al Sud.

La Banca d'Italia è in prima linea nell'aiutare le donne ad accrescere la loro cultura finanziaria: attraverso le proprie filiali organizza attività formative mirate, spesso in collaborazione con enti e associazioni, per contribuire a ridurre i divari di genere e contrastare la violenza economica.

Inoltre, mette a disposizione il percorso formativo intitolato "Le donne contano", completamente gratuito, pensato per parlare alle donne dei principi base della finanza personale: pianificazione finanziaria, strumenti di pagamento, home banking e sicurezza informatica, indebitamento e investimenti.

Come funziona il microcredito

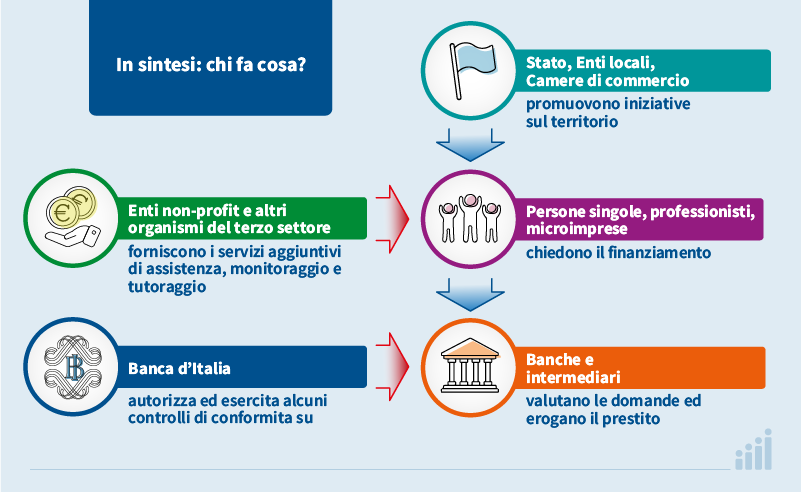

Se sei interessato a misure di microcredito imprenditoriale o di microcredito sociale, dovrai rivolgerti agli operatori autorizzati che valuteranno la tua richiesta. Questi decideranno se finanziarti oppure no, tenendo conto delle tue condizioni economiche e della tua capacità di sostenere il debito, cioè di pagare le rate con regolarità fino alla scadenza del prestito.

Non possono mai richiederti garanzie reali (beni immobili o mobili che, in casi estremi, possono essere venduti per restituire all'intermediario gli importi prestati): l'obiettivo del microcredito, infatti, è quello di sostenere persone e microimprese in condizioni di vulnerabilità e che non sono in grado di ottenere prestiti nei modi ordinari proprio perché non dispongono di certi tipi di garanzia.

Se il prestito è accordato, l'importo stabilito ti viene versato e tu ti impegni a restituirlo in un numero concordato di rate e a pagare gli interessi. Altri costi che devi generalmente sostenere sono le spese accessorie, come quelle per la gestione della pratica, o quelle per eventuali pagamenti tardivi. Fai sempre molta attenzione ai costi del finanziamento: una indicazione sintetica e approssimata del costo complessivo è il TAEG, il Tasso annuo effettivo globale. Trovi la descrizione di tutte le spese previste nei documenti informativi che la banca deve obbligatoriamente fornirti.

Il ruolo della Banca d'Italia sugli operatori di microcredito

Gli intermediari che operano nell'ambito del microcredito, i cosiddetti operatori del microcredito, sono autorizzati dalla Banca d'Italia che è responsabile di alcuni controlli consistenti nella possibilità di richiedere informazioni e documenti, effettuare ispezioni, vietare il compimento di nuove operazioni, imporre la riduzione delle attività e disporre la cancellazione dall'elenco in presenza di determinate circostanze. Non sono pertanto previsti controlli sulla sana e prudente gestione analoghi a quelli svolti nei confronti delle banche e degli intermediari finanziari, inerenti, ad esempio, allo stanziamento di risorse patrimoniali a fronte dei crediti erogati o all'adeguatezza dei presidi organizzativi per il controllo dei rischi assunti.

Gli intermediari finanziari devono essere iscritti in appositi albi e rispettare specifici requisiti di onorabilità, professionalità e organizzazione stabiliti dalla normativa vigente. Questo controllo garantisce che gli operatori agiscano in conformità con la normativa, assicurando trasparenza e sostenibilità nel settore del microcredito.

Consulta il sito dell'Ente nazionale per il Microcredito per saperne di più.

Youtube

Youtube

X - Banca d’Italia

X - Banca d’Italia

Linkedin

Linkedin

RSS

RSS